Red Sea crisis reality check: Supply chain ‘fluid,’ no ‘bonanza’ for container lines

Also in this issue: US imports saw surprise surge in January

(Photo: Flickr/Bernard Spragg)

Executives of Maersk, the world’s second-largest container line operator, spoke in-depth on the Red Sea crisis during a conference call on Feb. 8, providing the first detailed insider view on what is actually happening in the market.

For those expecting “Supply Chain Crisis 2.0,” it was a reality check.

“We are dealing with a situation that is fundamentally different than what we saw during COVID and will therefore play out very differently,” stressed Maersk CEO Vincent Clerc.

“This is in no way the type of bonanza we saw with the COVID situation. It’s really important for all of you to understand that.

“COVID disruptions occurred due to a sudden surge in demand that resulted in congestion and bottlenecks on the land side that clogged up the global supply chain. The Red Sea disruption, from a shipping perspective, is a rerouting of cargo along a longer route.

“We see no sign of congestion or bottlenecks or shifts in demand. The global supply chain remains fluid.

“Demand and supply are steady. This is because there are levers today to absorb the impact without further disruptions, by using the capacity that was underemployed at the end of 2023, by accelerating the service speed that had slowed down during 2023, and by gradually plugging new tonnage into existing rotations,” explained Clerc.

‘Just a matter of time’ before overcapacity strikes

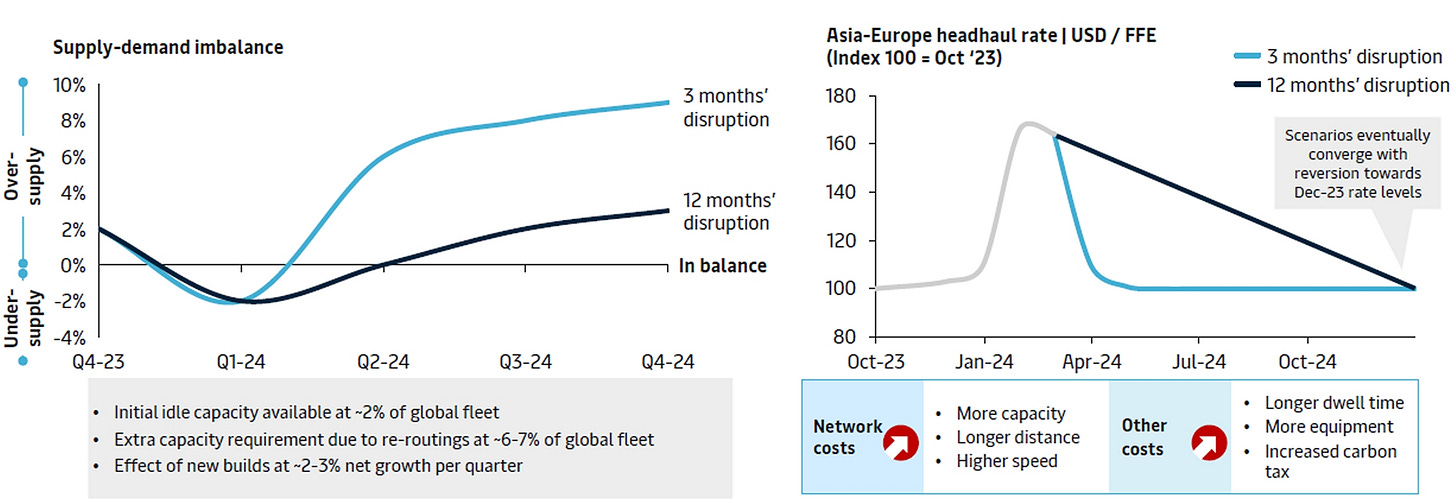

Vessel reroutings have increased global shipping capacity requirements by 6-7%, he said.

The use of previously underutilized capacity covers 2% of that gap, “and sailing the global fleet faster has so far cushioned most of the impact” of the remaining 4-5%.

Furthermore, “newbuilds will gradually phase in at 2-3% net growth per quarter and fill in the missing positions before the seasonal Q3 peak season and allow for a reduction of service speed. Therefore, it is just a matter of time. We estimate it will be a maximum of three quarters until the capacity issue is fully resolved.”

Maersk outlook on Red Sea impacts to supply-demand balance and rates. (Charts: Maersk investor presentation)

The threat to container line profits from overcapacity has not gone away, warned Clerc.

“We came into 2024 with a significant supply side challenge and that remains unchanged. The Red Sea disruption is absorbing some of the capacity temporarily. However, the structural imbalance will catch up to us during 2024 and will be exacerbated over time, irrespective of when the Red Sea situation is resolved.

“Regardless of the duration, we expect that new ship deliveries will eventually overwhelm the impact of Red Sea disruptions and rates will revert to pre-disruption levels.

“And if you look at the orderbook of ships that will be delivered in 2024, there are almost [as many] deliveries in 2025 – so, that is not good news.”

Liners face ‘immediate’ hit when Suez transits resume

The revenue reversal will be quick and painful once the Red Sea crisis is resolved and container ships once again transit the Suez Canal.

Maersk finalized its annual Asia-Europe contract rates just before the Red Sea crisis pushed up spot rates. This year’s contract rates, which cover over 65% of Maersk’s volumes, suffered “a significant downward adjustment” versus the prior year’s rates, said Clerc.

Liners are recouping extra costs on voyages that go around the Cape of Good Hope via surcharges added to contract rates.

But Maersk CFO Patrick Jany noted that added revenues from these surcharges will disappear overnight as soon as Suez voyages resume, while costs will linger. “When [disruptions] stop, we cannot charge those surcharges and we will still have additional costs to unwind,” he said.

According to Clerc, “The contractual terms are such that the moment the ships sail through the Suez again, these [surcharges] will go away automatically. There will be an immediate adjustment … an extremely rapid adjustment compared to what you would normally see.”

‘Ambiguous’ whether Red Sea effect is positive

As a result of the surcharges – which began with the very first voyages around the Cape of Good Hope – Maersk is likely to “over-recover on costs at the beginning and under-recover on costs at the end [because] some of the costs will stay with us for longer,” said Clerc.

Asked which costs will be “stickiest,” he pointed to extra container equipment that Maersk has had to buy or lease, and extra ships it has had to charter.

He likened the looming cost hangover to the situation after the COVID-era boom. “We got the benefits on the freight rates from the COVID disruptions, but those disruptions are gone and our unit costs are still not back to 2019 levels. That’s why Q4 looked the way it did.”

Maersk reported a net loss of $456 million for Q4 2023, and earnings before interest and taxes (EBIT) of minus-$537 million, considerably worse than the Bloomberg consensus for an EBIT loss of $454 million.

Red Sea disruptions had a minimal impact on Q4 2023 results and will begin to effect results in earnest this quarter.

“We will certainly have a better Q1 than we would have [due to disruptions],” said Jany. “It will help alleviate the losses we would have had … but whether we break even or not is another story.” He said Maersk should end Q1 “pretty close” to breakeven.

Maersk’s new full-year guidance further dispels the thesis of a Red Sea-driven earnings bonanza. It now expects full-year EBIT ranging from zero in the best-case scenario to a loss of $5 billion in the worst case. “The reality will probably be somewhere in between,” said Jany.

The midpoint of the guidance, at a loss of $2.5 billion, is far below the Bloomberg consensus for positive full-year EBIT of $841 million.

“Actually, it is still ambiguous today whether this situation seen as a whole is positive [for profits] or not … and whether the revenues we recoup will be enough to cover the costs that will be with us for a longer duration,” said Clerc.

Maersk’s Red Sea reality check sent liner shares tumbling. Maersk’s Copenhagen-listed shares plunged 15% on the day of the conference call in over quadruple average trading volume. Hapag-Lloyd’s Germany-listed shares fell 9%. Shares of Israeli carrier Zim (NYSE: ZIM) declined 8%.

Surprise January surge in US imports

Biggest jump in January imports vs. December in seven years

(Photo: Port of Los Angeles)

A popular narrative is that the drought in Panama, combined with lengthy diversions of container ships due to attacks in the Red Sea, will crimp U.S. imports.

Given the timing of Panama Canal constraints and Houthi attacks, this should be apparent in the January numbers – but there’s zero evidence of import shortfalls, according to data released by Descartes on Feb. 8.

To the contrary, imports jumped, driven by volumes to the West Coast from China.

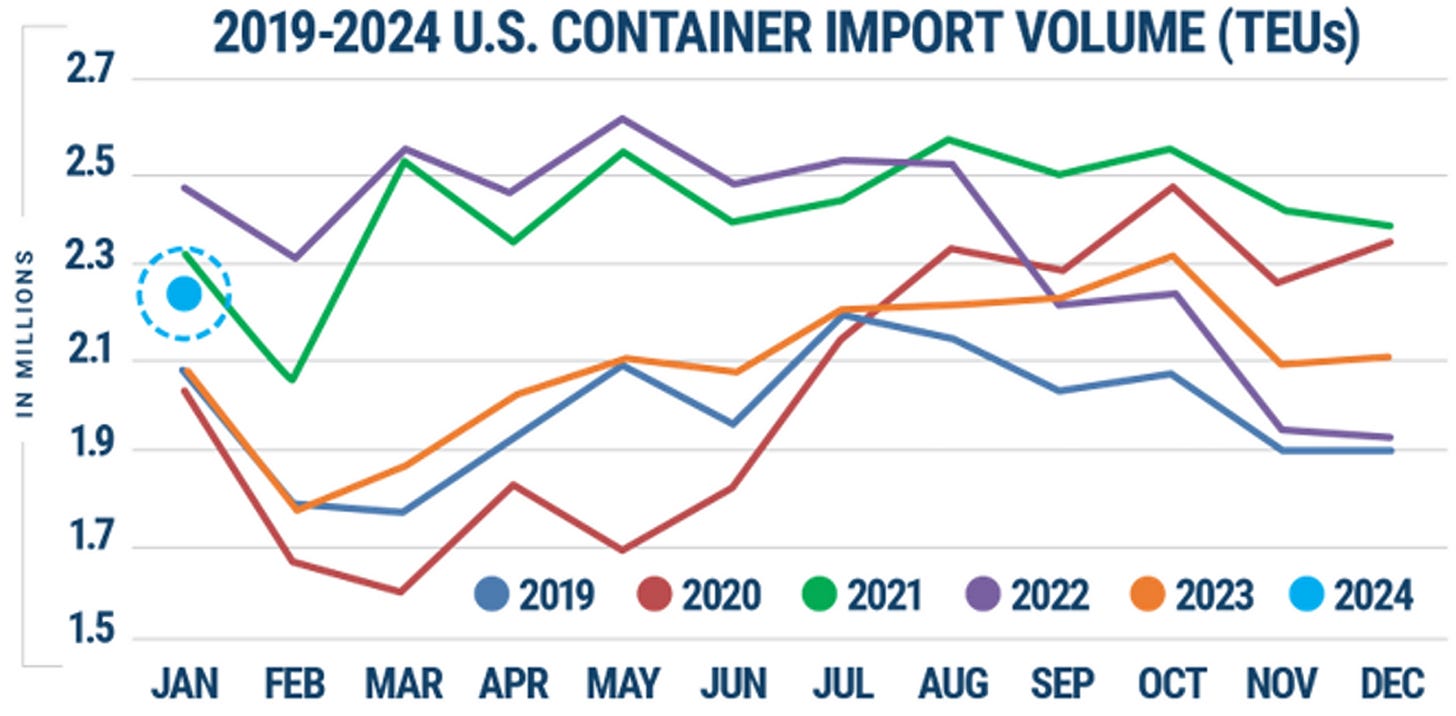

According to Descartes, U.S. ports imported 2,273,125 twenty-foot equivalent units (TEUs) in January, up 7.9% versus December – the biggest December-versus-January gain in seven years. This January’s imports were up 9.9% year on year.

(Chart: Descartes)

Chinese exports bolster West Coast volumes

On the port front, the biggest sequential gainers were West Coast ports Los Angeles (up 77,085 TEUs versus December, or 21.1%) and Long Beach (up 48,054 TEUs, 15.1%), while East/Gulf Coast ports Savannah, Charleston and Houston saw single-digit sequential losses, according to Descartes data.

Fallout from Panama Canal and Red Sea issues is apparent in the transit delay data. Delays to the top five East/Gulf Coast ports surged 30% in January versus December, whereas delays increased by 9% at the top five West Coast ports.

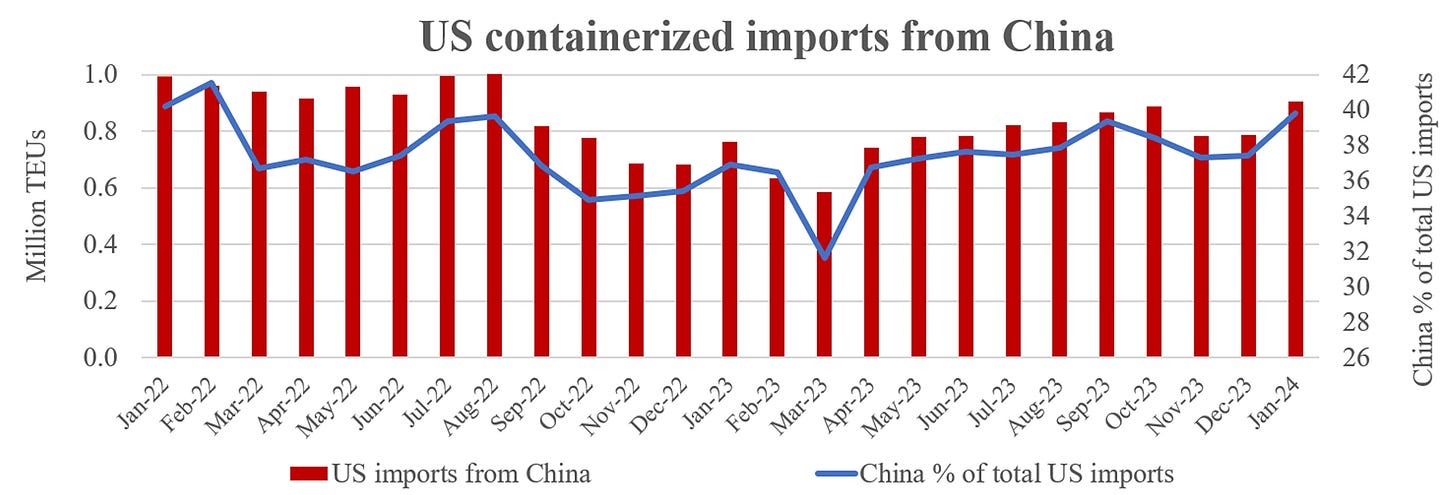

In terms of cargo origin, China was the overwhelming driver of January U.S. import strength, according to Descartes data. U.S. imports from China jumped 117,084 TEUs or 14.9% in January versus December. China’s share of total imports rose to 39.8% in January, the highest monthly percentage since September 2022, during the peak of the COVID-era supply chain crisis.

(Chart: Inside Shipping based on data from Descartes)

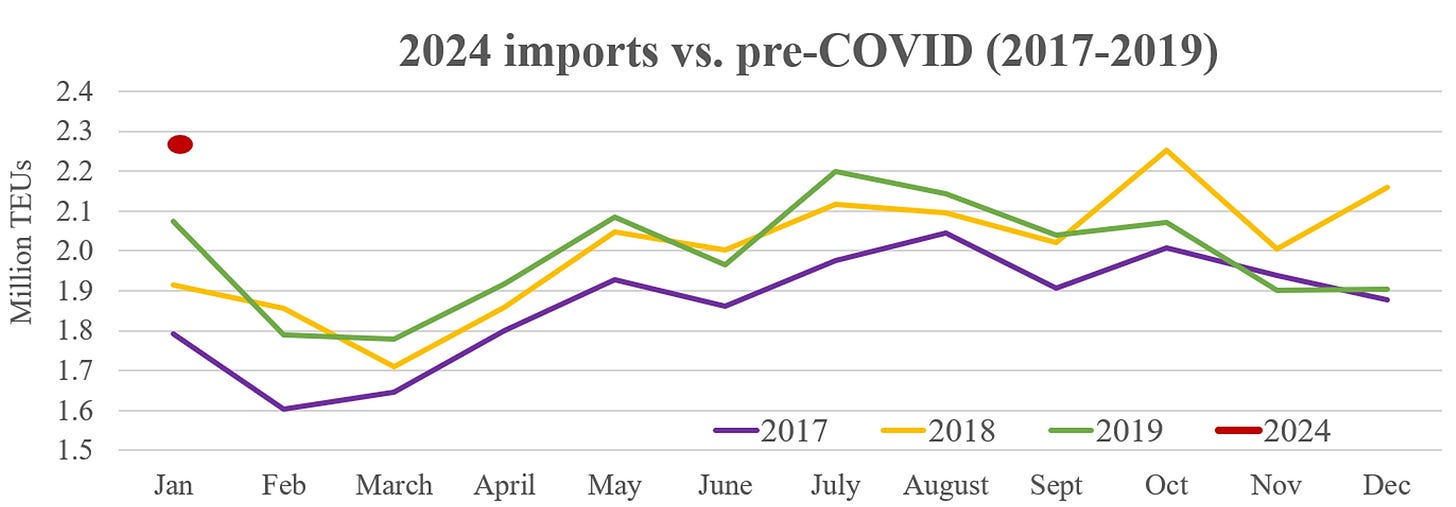

Compared to pre-COVID numbers, U.S. imports in January were extremely strong. This January’s imports were up 9.6% from the same month in 2019, 18.6% from 2018 and 26.8% from 2017. January 2024 imports were higher than in any month in 2017-2019, including peak-season months.

(Chart: Inside Shipping based on data from Descartes)

Thus, the situations in Panama and the Red Sea are causing widespread reroutings, yet the inherent flexibility of ocean shipping is allowing import flows to the U.S. to continue, and the persistent strength of U.S. consumer demand is keeping inbound volumes strong.

‘Demand is very stable’

Maersk CEO Vincent Clerc commented on container demand during the company’s quarterly call.

“It is important to remind ourselves that demand is not expected to be affected in any way by these disruptions,” he said. Maersk expects global container demand to grow by 2.5-4.5% in 2024 versus 2023.

“The beginning of 2023 was marked by some destocking, especially in the U.S. That worked itself out in the third quarter, and we saw volumes in the second part of the year become stronger. We expect that to continue on a sequential basis, with [more] growth in 2024.

“Demand is very stable. Actually, demand is more stable than it usually is,” said Clerc.

For Greg Miller’s full archive of articles written for FreightWaves in 2019-2024, click here.

Best wishes on Substack, Mr. Miller. Your articles are timely and about what matters. Looking forward to updates on clean tankers, and extent of switching from dirty to clean.

Great article, thanks.