Liner execs downplay Red Sea upside, punishing their own shares

Also in this issue: Panama Canal transits fell, yet again, in February

The bull case for container line stocks:

Disruptions at the Panama Canal and in the Red Sea dramatically increase voyage distances, offsetting newbuilding capacity additions. Disruptions are long-lasting, keeping extended voyage distances in place throughout this year, if not longer.

Spot rates remain elevated and surcharges boost liner contract revenues. Elevated spot rates push up the next round of trans-Pacific contract rates, which will be negotiated over the next two and a half months. Higher annual trans-Pacific rates bolster liner revenues for contract terms running from May 1, 2024, to April 30, 2025.

This upside is not yet reflected in liner stock prices, but it will be eventually.

The bear case for container line stocks:

Regardless of how long Panama Canal and Red Sea disruptions last, the impact on spot rates is temporary because networks adjust. Liners have plenty of extra vessel capacity to handle the longer routes, with more new ships delivered every week. Spot rates have already fallen back materially in the Asia-Europe trade and will follow suit in the Asia-U.S. trade.

As the onslaught of newbuilding capacity continues, spot rates will ultimately slump back to pre-disruption levels.

U.S. importers will “slow-walk” trans-Pacific contract negotiations this year and wait for spot rates to fall further. Even if spot rates don’t fall all the way back to pre-disruption levels by the time the new annual contracts are signed, importers won’t agree to significantly elevated contracts rates through April 30, 2025, because they will assume spot rates will be much lower at the back end of this annual period.

The reprieve that Panama Canal and Red Sea disruptions gave to shipping lines doesn’t change their eventual fate: Average rates (including contract and spot) will be below breakeven for an extended period at some point in the future, eating away at the cash cushions shipping lines amassed during the boom and preventing public shipping lines from paying dividends.

Stocks price in this future downside and give little weight to transitory, disruption-induced upside.

The container shipping lines themselves, much to the dismay of retail stock traders, have done little to support the bull case and have instead talked up the bear case.

First came the warning-filled Maersk call on Feb. 8, which caused Maersk’s shares to sink 15%. Then came the quarterly call of Zim (NYSE: ZIM) on March 13, which precipitated a 14% drop in Zim’s share price in double average volume.

Zim execs highlight downside risks

Zim introduced full-year 2024 guidance for earnings before interest and taxes (EBIT) of minus-$300 million to plus-$300 million. (Zim does not guide on net income, which is often lower than EBIT.)

During the conference call, Zim executives spent more time focusing on the downside scenario and on managing investor expectations lower.

“There is a fundamental difference between the current disruptions and the prevailing market conditions during the COVID-19 pandemic,” said Zim CEO Eli Glickman. “The COVID-era market was characterized by a significant increase in consumer demand accompanied by unprecedented supply chain disruptions. Current market conditions, on the other hand, are primarily supply-driven.”

That said, there is a demand factor in play. Zim CFO Xavier Destriau noted that spot rates appear to have peaked in January, coinciding with a temporary demand situation: “the seasonal cargo rush prior to Chinese New Year.” Going forward, he said, “Strong demand could potentially keep rates higher, but if demand is weak as shippers remain cautious on inventory levels, rates could continue to slide down.”

On the more important supply side, Zim executives highlighted the timing of the resolution of the Red Sea conflict and its impact on effective fleet capacity. While Destriau acknowledged that “there doesn’t appear to be a military or political resolution of the crisis in sight,” he warned that “this could change quickly.” If there is a resolution, “the rate adjustment might be quite severe and quite rapid.”

“We think there is a scenario where rates might go back, clearly, to where they were in October-November 2023.” (Rates at that time were well below breakeven for liners.)

Even in the more likely scenario of Red Sea diversions persisting for an extended period, Destriau cautioned that “new capacity will put additional pressure on the market” and “all the vessels coming into the trades between now and the end of the year – even if the Red Sea situation was to last for longer – will put pressure on the supply-demand equilibrium.”

He estimated that Red Sea diversions absorbed 6-7% of global capacity, whereas newbuildings will add 10% to global capacity this year (unmentioned was that there’s a lot more newbuilding capacity to come in 2025).

Furthermore, Destriau noted that shipping lines have “sidelined” capacity management measures such as slow steaming, ship idling and blank sailings, and 2024 scrapping is currently predicted to be minimal, at below 2% of global capacity.

The net result is that Zim expects disruptions to translate into better results in Q1 2024 than in Q4 2023, although that’s not saying much: Zim reported a net loss of $147 million in Q4 2023. Destriau said that disruptions could “potentially” benefit Q2 2024 results, and that “the second half is expected to be weaker than the first half.”

As for average rates in 2024, Zim expects them to be only “slightly” better than in 2023, even with the early gains already in the books.

Panama Canal transits still falling – but no supply chain crisis in sight

Newly released data from the Panama Canal Authority (ACP) shows that the total number of transits through the drought-stricken waterway fell yet again in February. However, the number of larger container ships transiting the Neopanamax locks increased – a positive for U.S. importer supply chains.

The ACP appears to be using its constricted water resources to favor its most lucrative clients: container lines serving the Asia-U.S. East Coast trade.

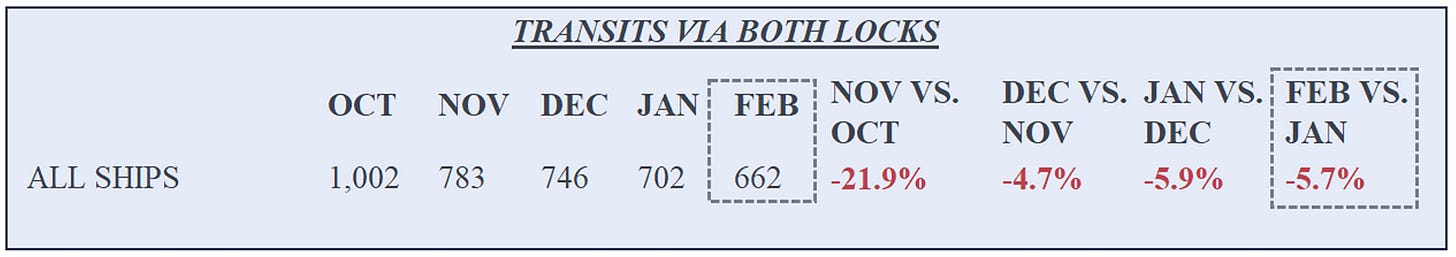

A total of 662 vessels transited the system in February, including both the smaller, older Panamax locks and the larger Neopanamax locks that debuted in 2016. That’s down 5.7% month on month and down 34% from October 2023, the first month of the canal’s fiscal year and the month immediately prior to transit restrictions.

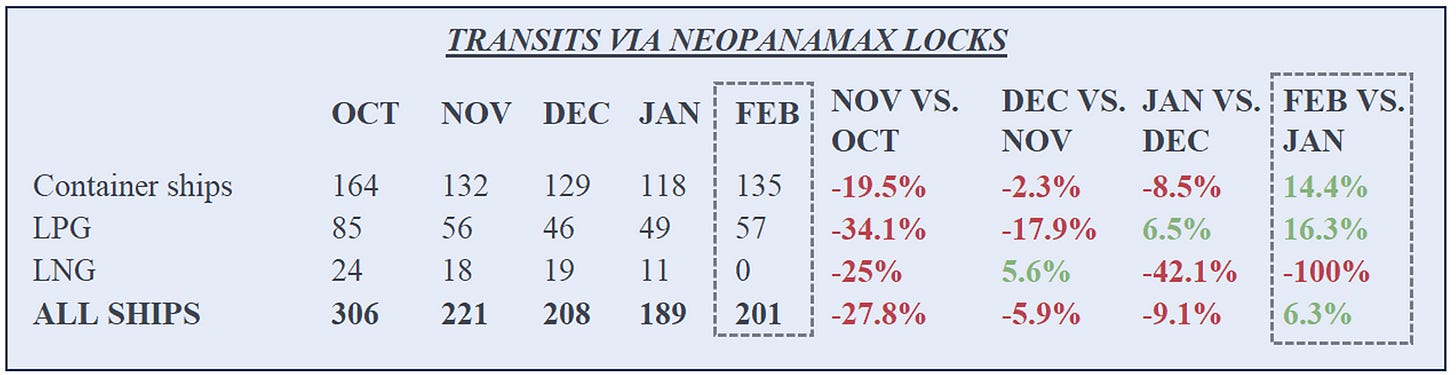

The good news: For the first time since transit restrictions began, traffic via the Neopanamax locks increased month on month.

There were 201 transits through the Neopanamax locks in February, up 6.3% from January, albeit still down 34% from October.

Neopanamax container ship transits rose 14% month on month, with transits of very large gas carriers (high-capacity LPG carriers) up 16%. No LNG ships passed through the waterway in February, according to ACP stats.

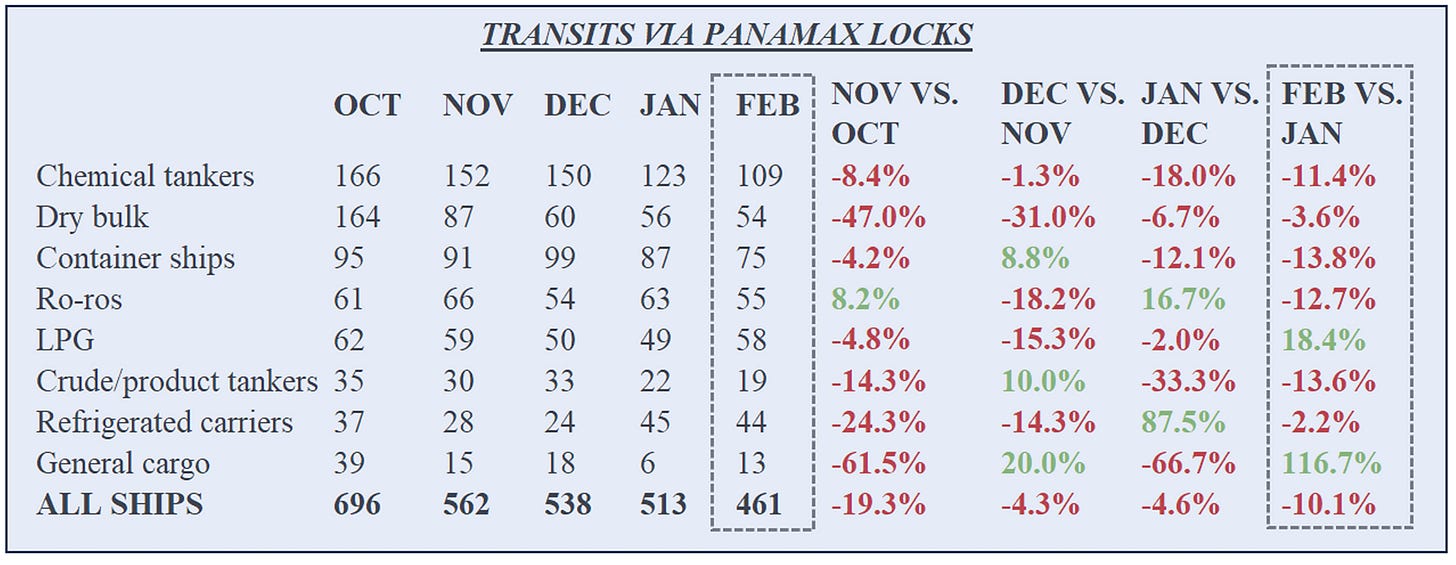

The driver of last month’s overall pullback was traffic at the Panamax locks. There were only 461 Panamax transits in February, down 10% versus January and down 34% versus October.

The biggest Panamax decliners last month were chemical tankers, crude tankers and product tankers. Since October, dry bulk ships have shown by far the largest cumulative drop: down 67%. Bulk carriers transporting U.S. grain to Asia have overwhelmingly shifted to the much longer Cape of Good Hope route.

The ACP recently announced that it will add three additional daily Panamax reservation slots starting in late March, bringing the total daily Panamax slots from 17 to 20 (Neopanamax slots will be unchanged, at seven per day). This has led to media coverage stating that the Panama Canal situation is improving, despite February transits being down, and despite ACP water level indicators still falling.

The reality is that increased slots do not necessarily translate into increase transits. Reservation slots rose in January versus December but transits still fell.

MSC says it’s ‘over the hump’

The confluence of the Panama Canal drought and the Red Sea attacks has led to heightened media coverage of potential supply chain fallout in the U.S., most recently in the Wall Street Journal.

Yet container shipping supply chains are highly flexible, particularly now, given the historic flood of new vessel capacity that’s coming online.

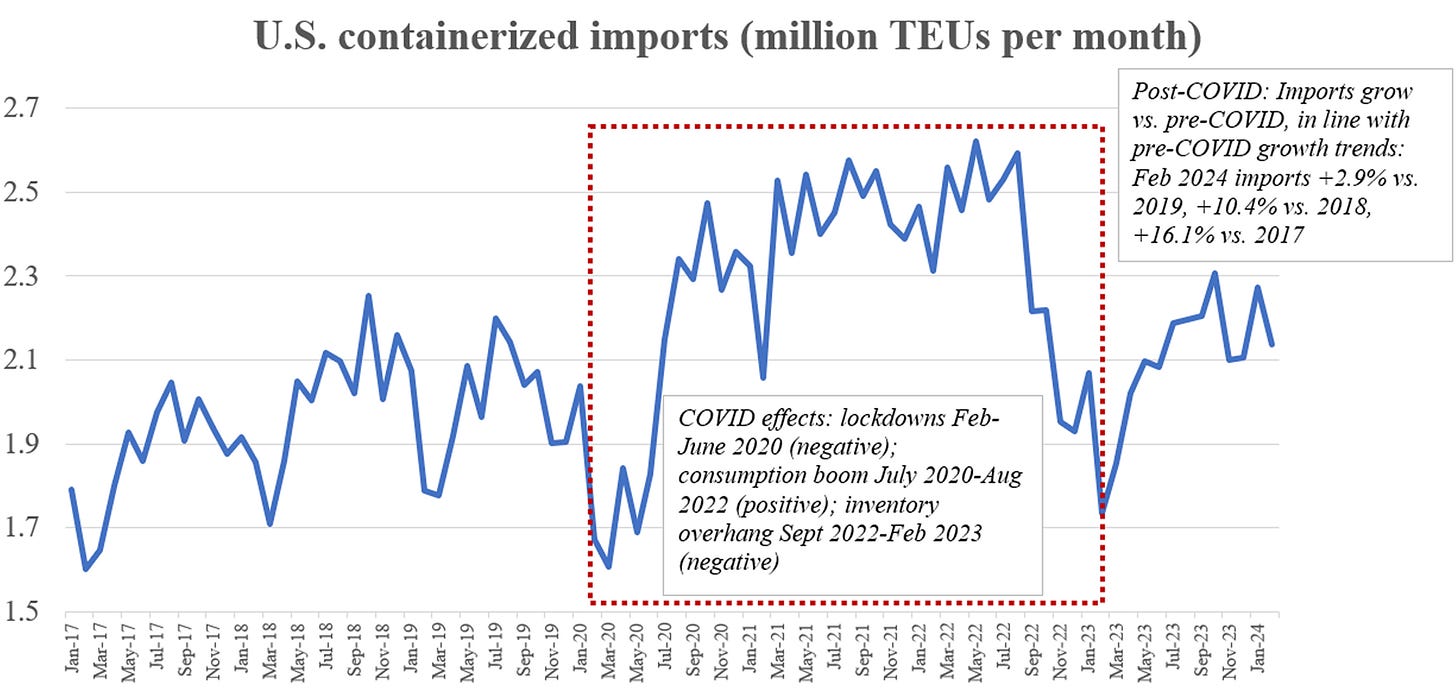

U.S. import numbers remain robust despite canal restrictions. According to the Descartes, the U.S. imported 2,137,724 twenty-foot equivalent units (TEUs) in February. Compared to pre-COVID levels, that was up 2.9% versus February 2019, 10.4% versus February 2018 and 16.1% versus February 2017.

Bud Darr, an executive vice president at MSC, the world’s largest shipping line, addressed the combined effect of the Panama Canal drought and Red Sea diversions at the Capital Link International Shipping Forum on March 11.

“I can say that for our network, the Panama Canal has not been significantly disruptive,” said Darr, explaining that MSC has been able to use its canal reservations to maintain service at a time when Asian exports to the East Coast and Gulf Coast have moderated, in part due to shipper concerns over a possible dockworker strike later this year.

The Red Sea impact on vessel demand “has been pretty dramatic,” he continued. However, Darr noted that “fortunately, there was a mismatch in capacity and demand in the marketplace at the time, and [MSC] had taken a strategy of dramatically growing our fleet, so we had the extra capacity to inject in our networks.

“We’re pretty confident that we’re over the hump with regards to adapting our networks worldwide,” said Darr. “From the perspective of importers, we’re at the point where it pretty much seems to be steady state.”

great article.

Greg are you at the CMA tommorow?